Source: MICR Technical Specifications – APCA (Australian Payments Clearing Association)

- Home

- General Info

- Solutions

- Overview of Cheque Clearing and Processing

- Cheque Truncation System (CTS)

- Cheque Fraud Solution

- Cheque Book Issuing Systems

- Cheque Entry Solutions

- Cheque Encoding Solutions

- Outward Clearing Solution

- Automated Cheque Settlement

- Inward Clearing Solutions

- Cheque Archival Solutions

- Teller Cheque Deposit Solution

- Products

- Support

- Company

MICR Code Line Specifications

MICR Code Line Specifications

The MICR code line contains up to 59 character positions numbered 1 to 59 from right to left. The MICR line is contained within a clear band which is 5/8 inch deep and positioned along the bottom of a document. The MICR line must be in a 1/4-inch strip centred in the 5/8 inch Clear Band. There is a 1/4 inch clear zone at both ends of the code line. The line is read from right to left and thus the first character space, numbered position 1, commences 5/16 ± 1/16 inch from the extreme right-hand edge of a document. The term “opened” also thus refers to the rightmost character in a field, this being the first character read.

The MICR line is grouped into six fields as follows, in order from right to left. These fields are normally separated by a blank (unprinted) position.

- Amount

- Transaction code

- Domestic or Account Number

- BSB

- Auxiliary Domestic (Serial number/Item count)

- Extra Auxiliary Domestic (Agent Number, Auxiliary Serial Number)

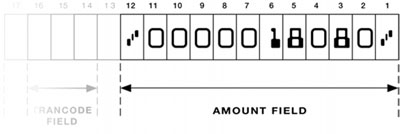

1. Amount Field

The amount field is a fixed format field that occupies the extreme right position. Positions 1 to 12 are reserved for this field. The first position, 1, must be opened by an Amount symbol. There are then ten spaces for the amount that must include two positions for the cents. The dollar amount must be right justified and zero filled to the left.

The responsibility for encoding this field rests with the clearing Financial Institution, not with the printer or issuer. With the advent of Image Capture, this field may not continue to be completed during the proofing process.

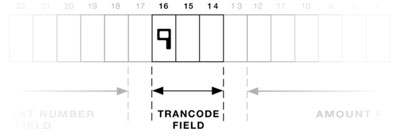

2. Transaction Code Field

Three positions (14-16) are reserved for this optional use field. Position 13 predominantly remains unprinted as a field separator. This field is used to identify the type of transaction taking place, or to indicate the expectation of data in other fields, e.g. the Extra Auxiliary field.

When shorter than maximum account numbers are used, Financial Institutions may elect to have the Transaction Code Field printed up to two spaces to the left i.e. positions 16-18.

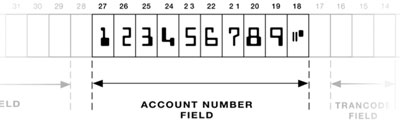

3. Domestic Field or Account Number Field

The account number is printed in this field which normally has 10 positions (18-27). Position 17 will usually be blank as a field separator. The field may be expanded to positions 17-28 in certain circumstances, when either or both the Transaction Code field and the BSB field are completed in the same printing operation.

The field must be opened by a Domestic symbol printed in position 18 (optionally position 17). No closing symbol is required.

An account number may occupy up to ten spaces, and may include a Dash symbol or a blank space. The format is determined by the Financial Institution and more than one format may be in use by the same Financial Institution.

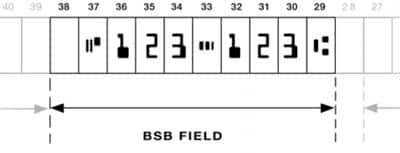

4. BSB Field

The issuing Financial Institution and its branch are identified by this field, for which ten spaces are reserved (29-38).

The Financial Institution is identified by a two- or three-digit numeric code allocated by APCA and placed in positions 34-36. For Institutions that have a two-digit code, the third digit in position 34 usually represents the State of the issuing branch. A Dash symbol in position 33 separates this code from a three-digit Branch identifier, issued by the relevant Financial Institution and printed in positions 30-32. The details of these codes are included in APCA Publication, “BSB Numbers in Australia”.

The field is opened by a BSB symbol in position 29; this character is always used as the reference character for position. The closing character, a Domestic symbol, can be in positions 37 or 38. The use of position 38 leaves a space between the Domestic symbol and the rest of the field and has previously been permitted, however it should not be used on deposit forms as this conflicts with the requirements for item count post encoding.

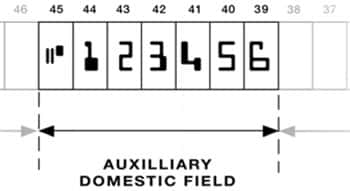

5. Auxiliary Domestic Field - Serial Number on Cheques

Seven spaces are normally reserved for this field, these being positions 39 – 45.

The opening Domestic symbol for this field is the closing symbol of the BSB field. This factor can cause reader/sorter processing problems when these fields are not printed at the same time (due to mis-alignment).

The most common form of this field consists of six digits in positions 39 through 44 with a closing Domestic symbol in position 45. For any variation please consult the relevant Financial Institution.

The field may be expanded to 11 spaces, i.e. nine digits plus Dash plus Domestic symbol.

Note:

Where the cheque serial number is greater than six digits the Transaction Code must be 9. The length of the form must be sufficient to ensure that the right-hand edge of the closing (left-most) symbol is not closer than 3/8 inch from the left or trailing edge of the form.

The rightmost digit of the serial number must be in position 39. A closing Domestic symbol must be printed in the leftmost position of the field, but not in a position greater than 49.

6. Auxiliary Domestic Field – Item Count on Deposit Forms

When this field is used with deposit forms for the Item Count, the field must be left blank when it is printed because the value is entered during the proofing process. It only contains a four digit field, normally in positions 39-42, with a closing Domestic symbol in position 43. This allows maximum flexibility with the adjacent Extra Auxiliary Domestic Field.

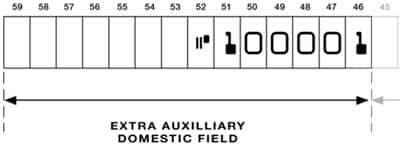

7. Extra Auxiliary Domestic Field (Agent Number or Auxiliary Serial Number Field)

There are 12 spaces (46 – 59) reserved for this field. The opening symbol for this field is the closing symbol of the Auxiliary Domestic field, if present, or the BSB field. A closing Domestic symbol forms part of this field.

This is an optional field and is commonly used on Deposit forms to identify specific depositors to the account, e.g. a branch store of a chain of retail outlets. It is often referred to as an Agent Number.

When printed as one operation a character space is not necessary between the closing symbol of the Auxiliary Domestic field and the rightmost character of the Extra Auxiliary Domestic field.

Note:

The length of the form must be sufficient to ensure that the right-hand edge of the closing (left-most) symbol is not closer than 3/8 inch from the left or trailing

edge of the form.

The right-most digit of the field must be printed in a position not less than 46 and not greater than 48. A closing Domestic symbol must be printed in the left-most position of the field, but not in a position greater than 59.

When the Auxiliary Domestic field and the Extra Auxiliary Domestic field are printed in one operation a space is not required between the fields. When the Auxiliary Domestic field and the Extra Auxiliary Domestic field are printed in different operations, a minimum of one space is to be provided between each field. If the Extra Auxiliary Domestic field is used for an agent number, consult the relevant Financial Institution for the structure as usage varies between Institutions.